The Era of Narrative Economy: Why C-Suites Must Rethink Global Strategy

By Dharminder Singh Kaleka and Jyotsna Mehra

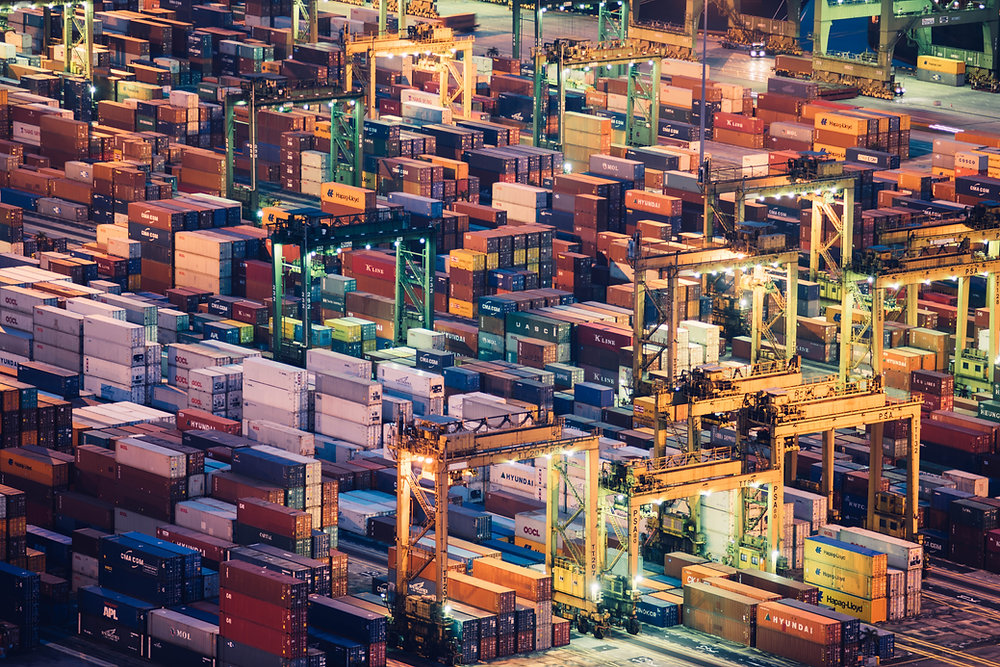

For decades, multinational corporations operated under the assumption that geopolitics was a peripheral consideration; an externality to be monitored, but rarely decisive in shaping global strategy. Supply chains were designed for efficiency and cost optimisation, with little attention to their geopolitical vulnerability. This paradigm is now obsolete.

Markets are no longer shaped by economic fundamentals alone. In what may be called the Era of Economic Narratives, perceptions of security, sovereignty, and technological alignment are increasingly shaping investment flows, supply chains, and market access. For firms operating across borders, especially in sensitive, critical sectors, understanding and engaging with state-driven economic narratives is becoming a prerequisite for long-term relevance and resilience.

A cascade of global shocks, especially over the last half-decade–COVID, armed conflicts, great power competition and weaponisation of regulation–has exposed the limitations of legacy strategic thinking. In this environment, geopolitical fluency is no longer optional. The ability to interpret both political shifts and the economic narratives driving investment, regulation, and public perception is now essential to business resilience and long-term competitiveness.

From Davos to Donetsk and Delhi: How Politics Redefined Commerce

The dual shocks of COVID-19 and the 2022 invasion of Ukraine marked critical inflection points in how businesses perceive geopolitical risk. The pandemic exposed deep vulnerabilities in hyper-globalised supply chains, forcing companies to rethink their assumptions about efficiency, redundancy, and resilience.

Just as firms began to adapt, the war in Ukraine delivered a more overt political shock: the speed and breadth of Western sanctions froze corporate assets, dismantled operations in Russia, and turned previously lucrative markets into high-risk zones. Energy price volatility and logistical disruptions rippled across global supply chains. Multinationals were forced to confront questions that had long been treated as secondary: How to protect personnel in conflict zones? Should operations in sanctioned countries be divested? What alternative supply chain configurations could insulate against geopolitical shocks?

Similar dynamics are visible in other regions. Gulf monarchies, for instance, are future-proofing their economies through aggressive state-led investments, with sovereign wealth funds allocating vast resources to AI, defence technologies, and renewable energy. Saudi Arabia’s Public Investment Fund, for instance, has pledged $40 billion to AI initiatives by 2026. These form part of broader strategic ambitions to diversify away from hydrocarbons, secure technological sovereignty, and position the region as a hub in the emerging multipolar digital economy.

In India, policy measures such as the Digital Personal Data Protection Act, along with “Atmanirbhar Bharat” and “Viksit Bharat” campaigns—which aim to build domestic capabilities as the country moves toward developed economy status—has created a regulatory landscape that prioritises national interests and technological self-sufficiency. While these initiatives are anchored in legal and technical rationales, they are also framed within a larger strategic narrative: projecting India as a secure, self-reliant, and future-ready economy. Companies seeking market access are increasingly evaluated based on their alignment with these national goals, not merely the competitiveness of their offerings.

The Compliance Fallacy: Why Traditional Risk Management Fails

Conventional approaches to political risk, treating it as a compliance issue or delegating it to government affairs teams are no longer sufficient. The experiences of firms such as TikTok and Huawei demonstrate the stakes. TikTok’s operations in both the United States and India became flashpoints for concerns over data sovereignty and national security, leading to bans and protracted legal challenges. Huawei faced abrupt exclusion from Western telecommunications infrastructure projects due to security fears, despite years of investment and market integration.

These cases represent extreme but instructive examples of what can happen when a firm becomes entangled in national policy debates it can’t shape or avoid. However, the level of geopolitical exposure varies significantly by sector, region, and the strategic sensitivity of a firm’s products or infrastructure.

Companies in sectors such as defense, digital infrastructure, cloud computing, and semiconductors are particularly vulnerable to regulatory intervention, while others may still operate with more latitude if they comply and avoid overt political entanglement.

Microsoft’s sovereign cloud services in India and the UAE illustrate a more adaptive strategy, anticipating the fragmentation of global data governance. Gartner projects that by the end of 2025, 80% of the world’s population will be covered by national privacy regulations. NVIDIA’s decision to redesign certain products to comply with U.S. export controls while maintaining a presence in China reflects similar geopolitical sensitivity.

In contrast, firms that merely monitor geopolitical developments from a distance often realise their exposure only once a restriction is imposed, and by then, strategic agility is no longer an option.

Six Capabilities for Strategic Resilience in the Era of Economic Story Wars |

|---|

Strategic Alignment Corporations must ensure their operational footprint aligns with politically stable and trusted jurisdictions. Apple’s decision to relocate production of all U.S.-bound iPhones to India exemplifies this approach. This move reduces dependency on Chinese manufacturing and aligns with India’s industrial policy objectives. Conversely, firms operating in politically sensitive regions, such as Xinjiang, have faced reputational risks and boycotts linked to human rights concerns. Location is no longer a neutral logistical choice; it communicates strategic and ethical positioning. |

Risk Acuity Effective geopolitical strategy requires more than reactive measures. It demands a forward-looking capacity to assess political, regulatory, and cultural shifts. Meta’s delayed response to India’s growing emphasis on data sovereignty hindered WhatsApp Pay’s rollout. By contrast, Palantir anticipated NATO’s increasing demand for advanced analytics and positioned itself as a trusted defence partner well ahead of its peers. |

Opportunity Sensing Geopolitical realignments also create openings for strategic engagement. Gulf nations, seeking to diversify from hydrocarbons, are investing heavily in emerging technologies. OpenAI’s early engagement with regional sovereign wealth funds positions it advantageously within these ecosystems. Companies that perceive such shifts as opportunities rather than threats are more likely to establish durable market positions. |

Foresight and Flexibility Organisations must plan for multiple geopolitical scenarios and maintain the flexibility to adjust operations rapidly. Tesla’s establishment of regional battery hubs was a strategic move to qualify for U.S. tax incentives and mitigate future trade disruptions. In contrast, firms with rigid global supply chains were paralysed during pandemic-related border closures. Foresight and flexibility are critical for resilience. |

Rapid Response Agility in the face of disruption is paramount. When Houthi attacks made the Red Sea unsafe for shipping in late 2023, Maersk rapidly rerouted vessels around the Cape of Good Hope, adding significant transit distances but ensuring continuity of service. Alternative logistics hubs and surcharges absorbed the impact of increased costs. Companies without comparable contingency planning suffered prolonged delays and financial losses. |

Structural Adaptability Organisational design must reflect geopolitical complexity. Microsoft’s development of region-specific cloud infrastructures is a response to diverging data localisation requirements and sovereign digital strategies. Decentralised decision-making empowers regional managers to act in line with local realities, rather than waiting for directives from distant headquarters. |

Narrative Economics: The Centrality of Stories

Markets are shaped as much by narratives as by economic fundamentals. States project stories of sovereignty and technological autonomy. Regulators frame debates around security and fairness. Consumers gravitate towards brands that resonate with their values and national identity. Palantir’s self-positioning as a national security partner secured it major contracts across NATO countries. TikTok’s inability to reconcile its Chinese ownership with Western privacy concerns has led to repeated regulatory challenges. Amazon’s ongoing antitrust battles in India highlight the consequences of failing to align with local economic narratives. Understanding and engaging with these narratives is no longer optional. It is an essential component of market strategy.

Moving From Defence to Positioning

Reactive approaches to geopolitical risk are insufficient. Companies must move towards actively shaping the political and cultural narratives in which they operate. Tesla’s localisation strategy to qualify for U.S. subsidies demonstrates how regulatory compliance can evolve into a competitive advantage. Firms persisting with “geo-agnostic” models risk marginalisation in key markets.

Boards and executives should reassess global footprints, corporate structures, and strategic assumptions. Critical questions include: Is our supply chain resilient to geopolitical shocks? Could our key markets impose unexpected restrictions? Are we perceived as partners in national development or as extractive outsiders? These are no longer hypothetical scenarios; they are emerging realities.

Rethinking Neutrality

Global commerce once operated under the assumption that geopolitical neutrality was possible: companies could succeed by staying commercially focused and politically agnostic. Today, this presumption is eroding. In many sectors, particularly those tied to data, infrastructure, energy, and AI, governments expect firms not just to comply with regulations but to align with national priorities. Firms are subject to scrutiny at every regulatory checkpoint and algorithmic filter, and judged not only by their market behaviour but by their perceived values, relationships, and allegiances. Supply chains, partnerships, even corporate narratives are subject to political interpretation. Neutrality is not gone, but it is no longer safe by default. In this environment, companies must decide where and how to position themselves in a world where being geo-agnostic is no longer a shield. Understanding the narratives shaping national agendas and determining where a company fits within them is becoming a prerequisite for sustained access and strategic acceptance.

Dharminder Singh Kaleka is an international lawyer and investment consultant, advising policymakers and global corporations seeking to navigate India’s regulatory, economic, and geopolitical landscape.

Jyotsna Mehra is the Founder and Lead of Research and Partnerships at Closed Door Policy Consulting.

The views expressed above belong to the author(s).